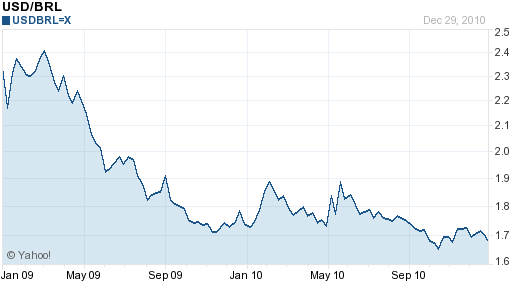

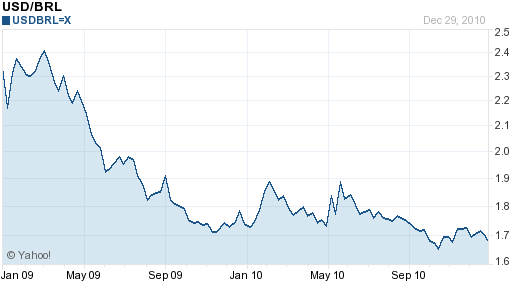

Despite all of the talk of currency war (a term first introduced by Brazili’s Finance Minister) and volatility in forex markets, the Brazilian Real is on pace to finish 2010 only slightly higher from where it began the year. While fundamentals would seem to support a further rise, Brazil’s government and Central Bank have made it clear that they will do everything in their combined power to prevent such an outcome. In short, the outlook for the Real in 2011 is incredibly uncertain.

There are two (somewhat contradictory) trends that have played a role in driving the Real to its current level. The first is the resurgence of the carry trade, whereby investors shift capital from low-risk, low-yield investments to higher-yield, higher-risk alternatives. With interest rates that are among the highest in the world – and certainly the highest among stable currencies – Brazil has been one of the prime recipients of carry trade funds. Since 2009, when concerns over the credit crisis began to ebb, the Real has risen a whopping 40%!

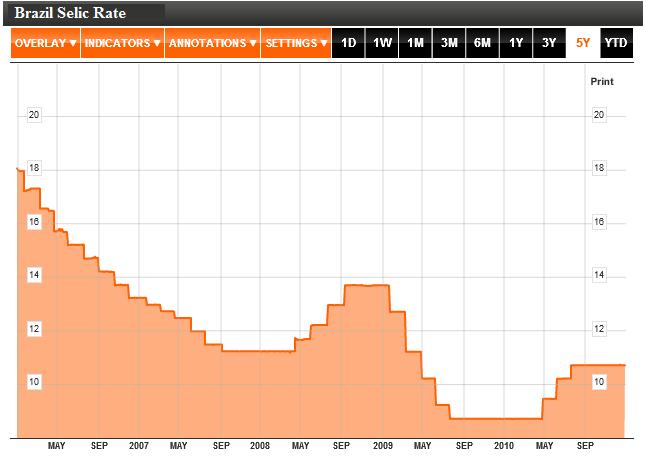

Moreover, the Central Bank might have no choice but to hike its benchmark Selic rate further over the next couple years. Inflation, at 5.5%, has already breached the Bank’s 4.5% target, and is projected to remain at an elevated level throughout 2011. According to futures prices, investors expect the bank to lift the Selic rate (currently at 10.75%) by 1.5% over the next twelve months, including a 50 basis point hike at its scheduled meeting in January. When you factor in low rates in the rest of the world, this would lift the yield spread between the Brazilian Real and most other comparable currencies to astronomical levels.

Alas, this first trend started to abate in the second half of 2010, due primarily to the EU sovereign debt crisis. Fortunately, the consequent move towards risk aversion hasn’t hurt the Real much. To be sure, Brazil is still an emerging-market economy, and is still perceived as being fraught with risk. However, when you consider that (certain) commodities prices (sugar, cotton) are at record highs and that the Brazilian economy barely dipped during the credit crisis, there are certainly riskier locales to park capital. Besides, many investors have determined that the interest rate premium that they receive from investing in Brazil is more than enough to compensate them for any added risk.

All else being equal, then, the Brazilian Real would probably continue rising at a measured pace in 2011. As I said, however, all else is not equal, since Brazil has pledged to do everything in their power to hold down the Real. According to the WSJ, “Earlier this year Brazil raised the IOF tax on foreign investment in fixed-income securities to 6% from 2% and also raised the tax for guarantees on derivatives investments.” Meanwhile, the Central Bank has intervened regularly in the spot market to purchase Dollars. The Bank’s newly appointed President, Alexandre Tombini, has voiced concerns over the Real’s rise: “We can’t let the economic policies of other countries determine the direction of foreign exchange.” On the day that he testified before the Senate’s Economic Affairs Committee, the Real fell by a substantial margin, suggesting that investors take his warnings seriously.

The Central Bank will also work closely with the new Brazilian administration to combat inflation, in a way that doesn’t cause the Real to appreciate. Rather than raise interest rates – which invites speculative capital inflows – the Bank will probably put pressure on the government to rein in spending and tighten access to credit. Over the long-term, this should allow it to lower rates to more sustainable levels, and prevent an expensive Rea from eroding the competitiveness of its export sector before it is too late.

Over the short-term, however, the immediate focus is to bring down inflation, most likely through rate hikes. That means that the Ministry of Finance will have to resort to more conventional weapons – such as taxes and intervention – to stem the Real’s rise. It managed to hold the Real to a 3% rise in 2010, but it remains to be seen whether it can repeat this feat in 2011.

There are two (somewhat contradictory) trends that have played a role in driving the Real to its current level. The first is the resurgence of the carry trade, whereby investors shift capital from low-risk, low-yield investments to higher-yield, higher-risk alternatives. With interest rates that are among the highest in the world – and certainly the highest among stable currencies – Brazil has been one of the prime recipients of carry trade funds. Since 2009, when concerns over the credit crisis began to ebb, the Real has risen a whopping 40%!

Moreover, the Central Bank might have no choice but to hike its benchmark Selic rate further over the next couple years. Inflation, at 5.5%, has already breached the Bank’s 4.5% target, and is projected to remain at an elevated level throughout 2011. According to futures prices, investors expect the bank to lift the Selic rate (currently at 10.75%) by 1.5% over the next twelve months, including a 50 basis point hike at its scheduled meeting in January. When you factor in low rates in the rest of the world, this would lift the yield spread between the Brazilian Real and most other comparable currencies to astronomical levels.

Alas, this first trend started to abate in the second half of 2010, due primarily to the EU sovereign debt crisis. Fortunately, the consequent move towards risk aversion hasn’t hurt the Real much. To be sure, Brazil is still an emerging-market economy, and is still perceived as being fraught with risk. However, when you consider that (certain) commodities prices (sugar, cotton) are at record highs and that the Brazilian economy barely dipped during the credit crisis, there are certainly riskier locales to park capital. Besides, many investors have determined that the interest rate premium that they receive from investing in Brazil is more than enough to compensate them for any added risk.

All else being equal, then, the Brazilian Real would probably continue rising at a measured pace in 2011. As I said, however, all else is not equal, since Brazil has pledged to do everything in their power to hold down the Real. According to the WSJ, “Earlier this year Brazil raised the IOF tax on foreign investment in fixed-income securities to 6% from 2% and also raised the tax for guarantees on derivatives investments.” Meanwhile, the Central Bank has intervened regularly in the spot market to purchase Dollars. The Bank’s newly appointed President, Alexandre Tombini, has voiced concerns over the Real’s rise: “We can’t let the economic policies of other countries determine the direction of foreign exchange.” On the day that he testified before the Senate’s Economic Affairs Committee, the Real fell by a substantial margin, suggesting that investors take his warnings seriously.

The Central Bank will also work closely with the new Brazilian administration to combat inflation, in a way that doesn’t cause the Real to appreciate. Rather than raise interest rates – which invites speculative capital inflows – the Bank will probably put pressure on the government to rein in spending and tighten access to credit. Over the long-term, this should allow it to lower rates to more sustainable levels, and prevent an expensive Rea from eroding the competitiveness of its export sector before it is too late.

Over the short-term, however, the immediate focus is to bring down inflation, most likely through rate hikes. That means that the Ministry of Finance will have to resort to more conventional weapons – such as taxes and intervention – to stem the Real’s rise. It managed to hold the Real to a 3% rise in 2010, but it remains to be seen whether it can repeat this feat in 2011.

No comments:

Post a Comment