Based on every measure, the Japanese Yen was the world’s best performing major currency in 2010. It notched up gains every one of its 16 major counterparts, and was the only G4 currency to appreciate on a trade-weighted basis. Against the US Dollar, it rose 10%, and touched a 15-year high in the process. However, there is reason to believe that the Yen is now overvalued, and that 2011 will see it decline to more sustainable levels.

I am still somewhat baffled as to why the Yen has risen so inexorably. It is said that “Hindsight is 20/20,” but in this case the benefit of hindsight doesn’t really provide any additional clarity. Of course, there was the Eurozone Sovereign debt crisis and the consequent shift of funds into safe-haven currencies, but let’s not forget that the fiscal problems of Japan are even more pronounced than in the EU. Premiums on credit default swaps signal that the probability of a Japanese government default is twice as high as it is for the US, and there are rumors of a downgrade in its sovereign credit rating. As one commentator summarized, “Just how the Japanese have got away with running up a debt to GDP ratio of over 200% (higher than the PIIGS and the U.S.) is beyond me.” Of course, it helps that this debt is financed almost entirely by domestic savings and is consequently not vulnerable to the changing whims of foreigners, but even so!

Meanwhile, the opportunity cost of investing in Japan is high. While inflation is moot, equity returns are low and bond yields are even lower. “Japanese 10-year yields, the lowest among 32 bond markets tracked by Bloomberg data, will end 2011 at 1.24 percent from 1.19 percent today, according to a weighted forecast of economists surveyed by Bloomberg News.” Combined with low short-term rates, it would seem that the Japanese Yen would be the perfect candidate for a carry trade strategy.

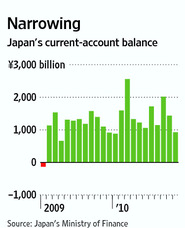

Although foreigners remain net buyers of Japanese Yen, the current account/trade surplus is gradually narrowing, with the former falling 16% year-over-year and the latter dropping 46%. It seems that “consumers overseas increasingly spurn Japanese products in favor of lower-priced goods from South Korea and other nations.”

Even the Japanese seem to prefer other currencies. According to NIKKEI, “Japanese investors were net buyers of foreign mid- and long-term bonds to the tune of 21.94 trillion yen in 2010, the most since comparable data began being compiled in January 2005.” Japanese companies are also taking advantage of the expensive Yen and strong balance sheets to buy overseas assets. The Economist reports that, “Japanese companies are sitting on a hoard of cash totalling more than ¥202 trillion ($2.4 trillion)…Many companies have earmarked vast sums for acquisitions in 2011 and beyond.”

With GDP projected to fall to 1% in 2011, there would seem to be very little reason to continue buying the Yen. According to the most recent CFTC Commitment of Traders Report, speculators are building up massive short positions in the Yen. Meanwhile, the Central Bank of China is quietly paring down its Yen holdings. Even the Bank of Japan seems to have embraced this inevitability, as it is has already stopped intervening in forex markets on the Yen’s behalf.

According to a Bloomberg News Survey, “Japan’s currency will tumble almost 10 percent against the dollar this year.” Very few analysts think that the bottom will complete fall out from under the Yen, but the majority (myself included) expect a correction of some kind.

I am still somewhat baffled as to why the Yen has risen so inexorably. It is said that “Hindsight is 20/20,” but in this case the benefit of hindsight doesn’t really provide any additional clarity. Of course, there was the Eurozone Sovereign debt crisis and the consequent shift of funds into safe-haven currencies, but let’s not forget that the fiscal problems of Japan are even more pronounced than in the EU. Premiums on credit default swaps signal that the probability of a Japanese government default is twice as high as it is for the US, and there are rumors of a downgrade in its sovereign credit rating. As one commentator summarized, “Just how the Japanese have got away with running up a debt to GDP ratio of over 200% (higher than the PIIGS and the U.S.) is beyond me.” Of course, it helps that this debt is financed almost entirely by domestic savings and is consequently not vulnerable to the changing whims of foreigners, but even so!

Meanwhile, the opportunity cost of investing in Japan is high. While inflation is moot, equity returns are low and bond yields are even lower. “Japanese 10-year yields, the lowest among 32 bond markets tracked by Bloomberg data, will end 2011 at 1.24 percent from 1.19 percent today, according to a weighted forecast of economists surveyed by Bloomberg News.” Combined with low short-term rates, it would seem that the Japanese Yen would be the perfect candidate for a carry trade strategy.

Although foreigners remain net buyers of Japanese Yen, the current account/trade surplus is gradually narrowing, with the former falling 16% year-over-year and the latter dropping 46%. It seems that “consumers overseas increasingly spurn Japanese products in favor of lower-priced goods from South Korea and other nations.”

Even the Japanese seem to prefer other currencies. According to NIKKEI, “Japanese investors were net buyers of foreign mid- and long-term bonds to the tune of 21.94 trillion yen in 2010, the most since comparable data began being compiled in January 2005.” Japanese companies are also taking advantage of the expensive Yen and strong balance sheets to buy overseas assets. The Economist reports that, “Japanese companies are sitting on a hoard of cash totalling more than ¥202 trillion ($2.4 trillion)…Many companies have earmarked vast sums for acquisitions in 2011 and beyond.”

With GDP projected to fall to 1% in 2011, there would seem to be very little reason to continue buying the Yen. According to the most recent CFTC Commitment of Traders Report, speculators are building up massive short positions in the Yen. Meanwhile, the Central Bank of China is quietly paring down its Yen holdings. Even the Bank of Japan seems to have embraced this inevitability, as it is has already stopped intervening in forex markets on the Yen’s behalf.

According to a Bloomberg News Survey, “Japan’s currency will tumble almost 10 percent against the dollar this year.” Very few analysts think that the bottom will complete fall out from under the Yen, but the majority (myself included) expect a correction of some kind.

No comments:

Post a Comment