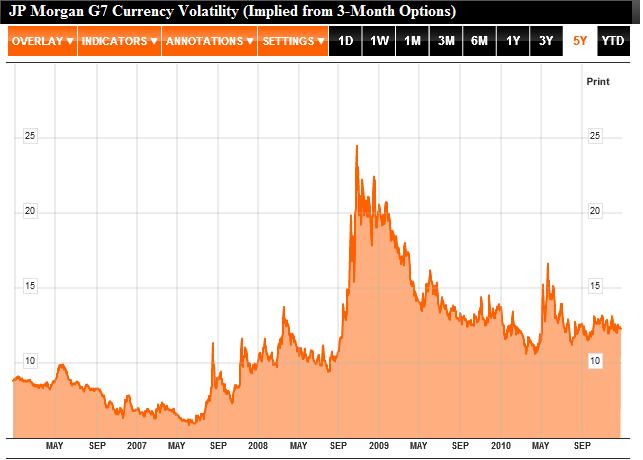

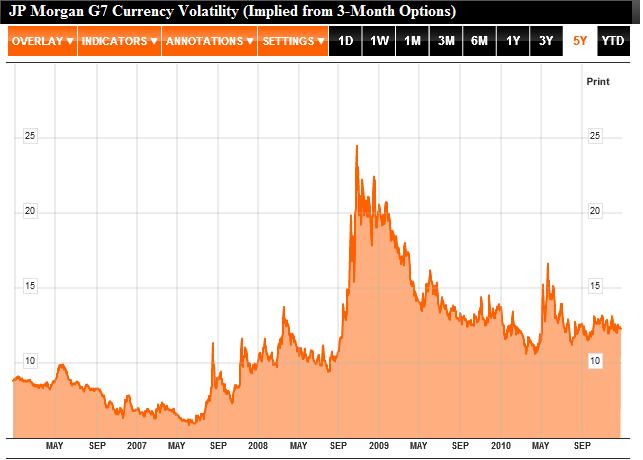

If you look at a chart of currency volatility over the last five years, two major spikes immediately jump out. The first took place in the wake of the collapse of Lehman Brothers in late 2008, while the second occurred earlier this year during the height of the EU sovereign debt crisis. While volatility has gradually subsided since then, it is still well above its historical average, and many analysts forecast that it will remain at an elevated level through at least 2011.

2010 was a volatile year for the forex markets for good reason. The EU sovereign debt crisis officially emerged, and spread from Greece to Ireland, and potentially to Portugal and Spain as well. There was uncertainty surrounding the impact of the Fed’s second quantitative easing program (QE2), as well as the impact of similar plans announced by the Bank of England and Bank of Japan. A handful of Central Banks ignited what has since been termed the “currency war,” which the G7/G20 are still trying to end. China allowed the Yuan to resume its upward march against the US Dollar, but at a pace that has failed to satisfy most critics. Emerging market currencies in general, and Asian currencies in particular surged, despite the best efforts of their respective Central Banks to contain them.

2010 was a volatile year for the forex markets for good reason. The EU sovereign debt crisis officially emerged, and spread from Greece to Ireland, and potentially to Portugal and Spain as well. There was uncertainty surrounding the impact of the Fed’s second quantitative easing program (QE2), as well as the impact of similar plans announced by the Bank of England and Bank of Japan. A handful of Central Banks ignited what has since been termed the “currency war,” which the G7/G20 are still trying to end. China allowed the Yuan to resume its upward march against the US Dollar, but at a pace that has failed to satisfy most critics. Emerging market currencies in general, and Asian currencies in particular surged, despite the best efforts of their respective Central Banks to contain them.

As a result, investors struggled to figure out what the right levels to buy and sell even the major currency pairs. The Euro has ranged from $1.1877 to $1.4579 (against the Dollar) so far this year; and the Yen has ranged from 80.22 to 94.99. Amidst this backdrop of volatility, investors once again flocked to the US Dollar. On a trade-weighted basis, it appreciated 5% for the year. Against its arch-rival, the Euro, it gained an impressive 10%. The Japanese Yen and Swiss Franc – the other two major safe-haven currencies – also outperformed, even touching record levels against some other currencies.

At this point, the only certainty is that uncertainty will persist well into 2011. Economic and monetary policymakers around the world will continue to struggle to keep (or merely put) their economies on the recovery track, while minimizing the risk of inflation in the medium-term. According to the currency strategy team at UBS, “There is…high risk of policy-maker error in relation to interest rates, quantitative easing and fiscal tightening.” To make matters worse, there is still a lack of coordination among, and in some cases, outright contradiction between countries’ respective policies. “There are doubts about the mutual consistency in economic strategies pursued by major economies…We have seen in recent weeks a tendency by countries to publicly challenge each others’ monetary or exchange rate policies,” said European Central Bank governing council member Christian Noyer.

At this point, the only certainty is that uncertainty will persist well into 2011. Economic and monetary policymakers around the world will continue to struggle to keep (or merely put) their economies on the recovery track, while minimizing the risk of inflation in the medium-term. According to the currency strategy team at UBS, “There is…high risk of policy-maker error in relation to interest rates, quantitative easing and fiscal tightening.” To make matters worse, there is still a lack of coordination among, and in some cases, outright contradiction between countries’ respective policies. “There are doubts about the mutual consistency in economic strategies pursued by major economies…We have seen in recent weeks a tendency by countries to publicly challenge each others’ monetary or exchange rate policies,” said European Central Bank governing council member Christian Noyer.

As a result, it’s more than likely that volatility levels will remain proportionately high. Added UBS, “The euro may range from $1.1 and $1.5…and U.S. dollar may touch as low as 70 yen and high as 100 yen in 2011…Overall investors will have to be more aware of foreign exchange risk in 2011. For at least several more years, volatility will be structurally higher.”

In this kind of environment, the implications are clear. While commodity and emerging market currencies may still be girded by strong fundamentals, a lack of investor risk appetite could trigger another round of capital flight. Meanwhile, the US Dollar (and other safe haven currencies) will benefit, and the Euro will suffer.

As a result, investors struggled to figure out what the right levels to buy and sell even the major currency pairs. The Euro has ranged from $1.1877 to $1.4579 (against the Dollar) so far this year; and the Yen has ranged from 80.22 to 94.99. Amidst this backdrop of volatility, investors once again flocked to the US Dollar. On a trade-weighted basis, it appreciated 5% for the year. Against its arch-rival, the Euro, it gained an impressive 10%. The Japanese Yen and Swiss Franc – the other two major safe-haven currencies – also outperformed, even touching record levels against some other currencies.

As a result, it’s more than likely that volatility levels will remain proportionately high. Added UBS, “The euro may range from $1.1 and $1.5…and U.S. dollar may touch as low as 70 yen and high as 100 yen in 2011…Overall investors will have to be more aware of foreign exchange risk in 2011. For at least several more years, volatility will be structurally higher.”

In this kind of environment, the implications are clear. While commodity and emerging market currencies may still be girded by strong fundamentals, a lack of investor risk appetite could trigger another round of capital flight. Meanwhile, the US Dollar (and other safe haven currencies) will benefit, and the Euro will suffer.

No comments:

Post a Comment